Reader Request: What Happened to All That Value?

I LOVE receiving feedback from readers, good or bad. Lately I've had trouble thinking of original ideas to write about. When I used to write every week for the Standard-Speaker, I never lacked for topics because readers emailed me all sorts of questions and opinions. I hope "Reader Request" will become a regular feature, but of course...that all depends on you, doesn't it?

I LOVE receiving feedback from readers, good or bad. Lately I've had trouble thinking of original ideas to write about. When I used to write every week for the Standard-Speaker, I never lacked for topics because readers emailed me all sorts of questions and opinions. I hope "Reader Request" will become a regular feature, but of course...that all depends on you, doesn't it?

A reader asks: My 28-year-old son just purchased his first home. He has a job but makes very little money. Nonetheless, he was able to make this important first investment because the house was available for sale as a result of foreclosure. This economic circumstance reduced the price of the house to the point that, inspite of his meager means, he was able to afford it. Where did the difference in the foreclosed debt and the value in excess of the price he paid in the transaction come from? Ironically, he is entitled to the Government's $8k tax credit for first-time home buyers which he did not need to affect the purchase.

This is another way of asking how something can be worth $100 one day and $50 a year later. It's the same object. Nothing in it changed.

The short answer is, prices don't always reflect an asset's "value" accurately. (There's a school of economics that believes in the "Efficient Market Hypothesis." They'd disagree with me, but that's a conversation for another day.)

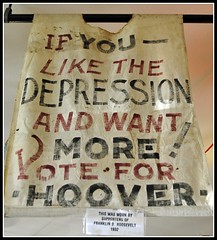

The market can screw up. Maybe that asset wasn't worth $100. Maybe its value is $50, but something went horribly wrong and people mistakenly thought it was worth $100. That's what economists mean when they call it a "bubble."

The market can screw up. Maybe that asset wasn't worth $100. Maybe its value is $50, but something went horribly wrong and people mistakenly thought it was worth $100. That's what economists mean when they call it a "bubble."

Or maybe its value is $100. Maybe something has now gone horribly wrong and people mistakenly think it's worth $50. That's what banks told us back in late 2008 and early 2009, during the whole "nationalization" debate. They said the price crash was only temporary. When markets regain their senses, they'll realize the assets were worth $100 all along...or at least $90.

A lot of economists are writing a lot of books and papers to explain why house prices rose and fell so precipitously. I'm writing one of those books, so I can't fully answer the question here. If you ask Robert Shiller, he'll tell you it's because people just get irrationally exuberant sometimes. If you ask Edward Glaeser, Joseph Gyourko, and Albert Saiz, they'll say it's because demand outpaced supply for awhile.

But home prices weren't the only thing rising and falling. Debt -- consumer credit, mortgage loans, etc -- exhibited "bubble" behavior too. Many of us think the "credit bubble" caused the "housing bubble." In this case, the price of debt was too low, causing people to borrow too much.

Economists have a lot of opinions about this bubble too. Raghuram Rajan argues that the Fed kept interest rates too low, and people couldn't keep up with the interest payments when rates rose. Charles Calomiris and Peter Wallison blame Fannie Mae and Freddie Mac for originating mortgages to people who couldn't pay them back in the long run (and for buying those mortgages, increasing the demand for them). Susan Wachter, Adam Levitin, and Andrey Pavlov rest the burden on Wall Street, whose insatiable appetite for securitized junk created a growing demand for risky mortgages.

So, to return to the question, where did the difference come from? Depends whom you believe. Wachter, Levitin, and Pavlov have the most convincing evidence to support their case. The other arguments have too many holes to be the primary cause, but all probably played a contributing role.

So, to return to the question, where did the difference come from? Depends whom you believe. Wachter, Levitin, and Pavlov have the most convincing evidence to support their case. The other arguments have too many holes to be the primary cause, but all probably played a contributing role.

There's another way to look at this question: How did $11 trillion of wealth disappear?

We tend to think of wealth as something we can hold in our hand. If someone's wealth decreases, it must go somewhere, right? Not exactly. Wealth contains a lot of promises (that's all debt is: a promise to pay in the future) and prices (which, as we've learned, can change in a heartbeat).

On that note, I'll conclude by directing you to Princeton economist Uwe Reinhardt's must-read answer to this question: Where All That Money Went.