Bubble, Bubble, Toil and Trouble

Just a thought from something I read yesterday with regards to "the education bubble."

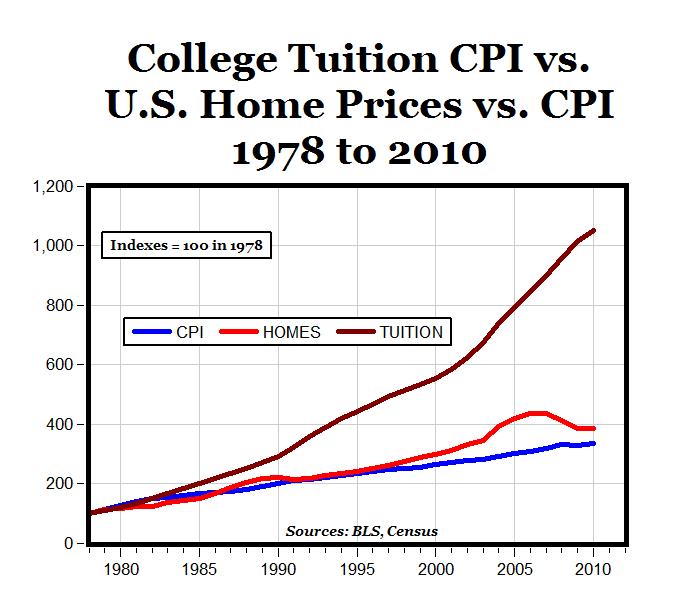

Here’s the quick and dirty: When indexed to inflation, student tuition costs in higher education have far outpaced both housing prices and medical spending (as well as CPI). What happens when the bubble pops?

Says University of Tennessee blogger, author, and law Professor Glenn Reynolds:

It's a story of an industry that may sound familiar.

The buyers think what they're buying will appreciate in value, making them rich in the future. The product grows more and more elaborate, and more and more expensive, but the expense is offset by cheap credit provided by sellers eager to encourage buyers to buy.

Buyers see that everyone else is taking on mounds of debt, and so are more comfortable when they do so themselves; besides, for a generation, the value of what they're buying has gone up steadily. What could go wrong? Everything continues smoothly until, at some point, it doesn't.

Yes, this sounds like the housing bubble, but I'm afraid it's also sounding a lot like a still-inflating higher education bubble. And despite (or because of) the fact that my day job involves higher education, I think it's better for us to face up to what's going on before the bubble bursts messily.

College has gotten a lot more expensive. A recent Money magazine report notes: "After adjusting for financial aid, the amount families pay for college has skyrocketed 439 percent since 1982. ... Normal supply and demand can't begin to explain cost increases of this magnitude."

Note that the education bubble dwarfs the housing bubble when indexed to CPI, via University of Michigan Professor Mark J. Perry at his blog, Carpe Deim:

[The above chart] shows the housing bubble in the U.S., using monthly median new home prices (Census data here) and the monthly Consumer Price Index (CPI, data here), back to 1978, where both series are adjusted to equal a value of 100 in January 1978. The bottom chart illustrates a much, much bigger bubble than the real estate bubble - the "higher education bubble" - based on an annual comparison of the CPI, median new home prices and the CPI for "College Tuition and Fees" (data here). Note that the housing bubble resulted from about a 4-time increase in home prices between 1978 and 2006, and college tuition has now increased by more than twice that amount since 1978 - it's gone up by more than a factor of ten times. The college tuition bubble makes the housing price bubble seem pretty lame by comparison.

When the "education bubble" pops, as all bubbles do, what kind of shape will the Education Industry be in? Have the prices of goods and services (textbooks, rents, food plans, etc.) trended closer to CPI or tuition cost? Can universities justify their rents and services when pressure comes to rollback pricing? What happens if student loans begin defaulting, much like buyers are defaulting on mortgages? What happens to graduate entering a jobless recovery while being 'upside down' in their educations?