You Heard It Here First

Yesterday, The New York Times profiled Harvard professor David A. Moss, who is researching the relation between income inequality and financial crises. Apparently, this connection just "came to Mr. Moss about a year ago." The usually-savvy financial commentator Yves Smith thinks Moss is putting forward "a bold thesis" because inequality is more likely "a secondary contributor."

Yesterday, The New York Times profiled Harvard professor David A. Moss, who is researching the relation between income inequality and financial crises. Apparently, this connection just "came to Mr. Moss about a year ago." The usually-savvy financial commentator Yves Smith thinks Moss is putting forward "a bold thesis" because inequality is more likely "a secondary contributor."

I have to admit my surprise that Moss and Smith are, well, surprised.

I wrote about this dynamic in December 2008 (and again in October 2009). Hey, can I be a Harvard professor too?

Smith's is not a naive viewpoint. In her mind, the growing power of the financial industry caused both inequality and the 2007-09 crisis. MIT economist Simon Johnson wrote the most famous article on this theory.

I do not disagree with them, but I believe the big picture is more complicated. University of Chicago economist Raghuram Rajan agrees with me. We're looking at debt as a positive feedback loop. More powerful banks exacerbate inequality and make the economy more susceptible to debt crises, but that inequality encourages more borrowing as an antidote to stagnating wages.

But wait, it gets even more complicated than Rajan suggests. As another savvy financial commentator, Steve Randy Waldman, explained way-too-briefly last week, inequality -- or at least the declining power of labor that it represents -- turned the accelerating inflation of the 1960s and 1970s into the asset price bubbles of the past three decades:

One can imagine that, prior to the 1980s, the marginal unit of CPI was purchased from wages. That made managing inflation difficult. In order to suppress the price level, central bankers had to reduce the supply of wages.

Then came the "Great Moderation". The signal fact of the Great Moderation was that the marginal unit of CPI was purchased from asset-related wealth and consumer credit rather than from wages.

In exchange for price stability and moderate business cycles, we mangled the price signals that ought to have disciplined capital allocation, we levered and impoverished American households, we transformed our financial system into a fragile and corrupt cesspool of self-congratulatory rent-seekers.

If you didn't understand that, don't worry. I devote a significant portion of my forthcoming book to describing this transformation.

If you didn't understand that, don't worry. I devote a significant portion of my forthcoming book to describing this transformation.

Until I finish my book, it seems Americans need someone to explain to them how income inequality threatens the economy (including how it's suppressing the recovery). Here's an idea: The New York Times Magazine should hire Robert Reich, who is one of the few commentators who recognizes the seriousness of this structural deficiency, to put the pieces of the puzzle together in a long-form essay.

If Reich is too busy, maybe they can ask the guy who wrote these words in August 2008:

Recessions happen, but wage stagnation should not. Despite economic growth over the last decade, [real] wages never changed. If the average worker is not benefiting from a growing economy, then it is not functioning properly. This isn't an ideological issue. If the majority of people don’t benefit from the economy, then what’s the point?

Which makes it easier to understand why debt has soared and saving has plummeted -- wages didn't cover expenses, so people borrowed and emptied their piggy banks. And the current plague of locusts ensued.

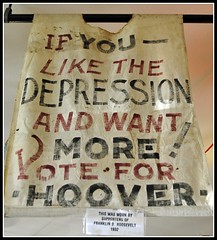

But you don’t hear candidates explaining that chain of events. They blame greed or President Bush or Democrats or taxes because that’s how you get elected. It’s easier to blame boogeymen than to educate people, but it’s also dishonest and it makes it harder to enact large structural changes after you are elected.

The [real problem] is not foreclosures or high taxes or lack of health insurance or gas prices or whatever the candidates choose to vilify today. It is that the economy incentives the wrong behavior and doesn’t benefit the average American.

Two years later, he's sitting in Los Angeles, wondering why people are still shocked by this news.